Ever received a medical bill and felt like you needed a decoder ring to understand it? You’re not alone! The medical billing process in the USA can be confusing, even for the most health-conscious individuals. But fear not because this guide is here to unveil the mysteries behind those cryptic codes and complicated claims.

In the complex world of healthcare, one crucial aspect often overlooked is the medical billing process. Understanding how medical bills are generated, submitted, and processed is essential for both healthcare providers and patients alike. In this comprehensive guide, we’ll delve into the intricacies of the medical billing process in the USA, exploring its steps, procedures, and ways to improve efficiency.

What is Medical Billing Process

Think of the medical billing process as the journey your healthcare visit takes after you leave the doctor’s office. It’s all about getting you the care you need, ensuring the doctor gets paid, and your insurance company shoulders its share of the cost. Here’s a breakdown of the key players:

- You (the Patient): You receive healthcare services and incur medical bills.

- Healthcare Provider (Doctor, Hospital, Clinic): They provide medical services and submit claims to your insurance company for reimbursement.

- Insurance Company: They review the claims, determine their financial responsibility, and send an Explanation of Benefits (EOB) outlining what they’ll cover.

The medical billing process refers to the sequence of steps involved in submitting and processing claims for healthcare services rendered to patients. It begins when a patient receives medical treatment and ends when the healthcare provider receives payment for their services.

Table of Contents

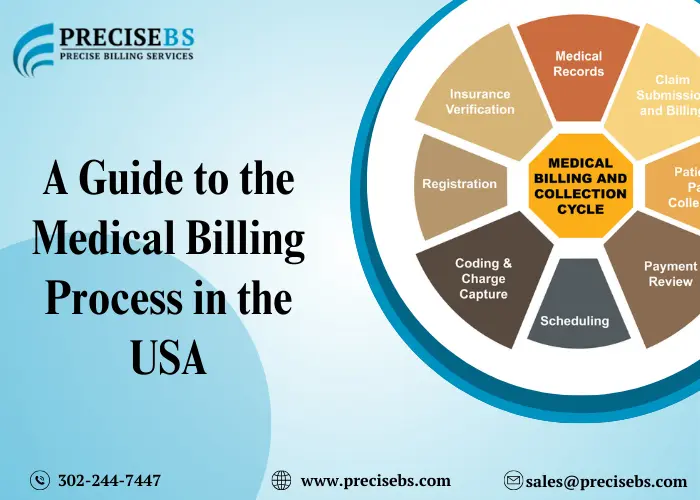

The 10 Medical Billing Process Steps: A Simplified Look

Now, let’s delve into the 10 steps that make up this process:

| Registration and Verification | When you schedule your appointment, the healthcare provider collects your insurance information. They verify your eligibility and coverage to ensure your insurance will help pay for the services. |

| Service Delivery | You visit the doctor, receive treatment, and likely incur charges for the service itself, as well as any medications, lab tests, or X-rays used. |

| Coding and Charge Capture | After your visit, a medical coder translates the services you received into standardized medical codes. These codes determine how much the insurance company reimburses the provider. |

| Claim Submission | The healthcare provider creates a claim, which is an electronic bill sent to your insurance company. It details the services provided, the associated codes, and the charges. |

| Claim Review and Adjudication: | The insurance company receives the claim and meticulously reviews it. They check for errors, ensure the services are medically necessary, and verify your coverage for those specific services. |

| Explanation of Benefits (EOB): | If the insurance company approves the claim, you’ll receive an EOB. This document explains what the insurance company will cover, what your portion (deductible and copay) might be, and any remaining balance due. |

| Payment Posting: | You’ll receive a bill from the healthcare provider for the services rendered. This might include your portion (deductible, copay) not covered by insurance. Make sure the charges on the bill match the EOB. |

| Patient Payment or Denial: | You have the option to pay the bill in full, set up a payment plan, or potentially dispute any charges you believe are incorrect. |

| Collections (if applicable): | If you don’t pay the bill, it might be sent to collections after a certain period. This can negatively impact your credit score. |

| Denial and Appeal Process: | If your insurance company denies your claim, you have the right to appeal the decision. This process involves gathering documentation to support the medical necessity of the service. |

Related Article: What is Claim Submission

Understanding the Claim Submission Process in Medical Billing Process

The claim submission process is a crucial step, and any errors can lead to delays or even denials. Here are some common reasons claims get denied:

- Coding Errors: Mistakes in medical codes can make the insurance company clear, leading to rejection.

- Need to include Information: Incomplete claims lacking necessary details might get bounced back.

- Lack of Medical Necessity: If the insurance company deems a service unnecessary for your condition, they might only allow coverage.

How to Improve the Medical Billing Process

While the medical billing process might seem complex, you can take steps to navigate it more smoothly:

- Ask Questions: Don’t hesitate to ask your healthcare provider or insurance company for clarification about any charges or procedures.

- Review Bills Carefully: Check for errors in coding or billing before making a payment.

- Keep Records: Maintain copies of EOBs, bills, and any communication with your insurance company.

- Understand Your Insurance Coverage: Familiarize yourself with your policy’s terms, deductibles, and copays.

Related Article: What is Medical Billing

Strategies for Enhancing Medical Billing Process Efficiency and Accuracy

Efficiency and accuracy are paramount in the medical billing process. Here are some strategies to enhance its effectiveness:

- Implement Electronic Health Records (EHR): EHR systems streamline documentation, coding, and billing processes, reducing errors and improving communication between healthcare providers and insurers.

- Regular Staff Training: Continuous education and training ensure that staff stay updated on evolving billing regulations, coding guidelines, and best practices.

- Utilize Revenue Cycle Management (RCM) Software: RCM software automates billing tasks, tracks claims, and identifies potential issues early in the process, leading to faster reimbursement and improved revenue flow.

- Conduct Regular Audits: Routine audits of coding and billing practices help identify errors, compliance issues, and areas for improvement, minimizing claim denials and revenue loss.

Related Article: Who Are Medical Billers

Denial Process in Medical Billing and How to Appeal

If you receive a denial, don’t despair. Here’s how to appeal:

- Gather Documentation: Obtain a copy of the denial letter and any medical records supporting the service’s necessity.

- Contact Your Insurance Company: Call their customer service and inquire about the appeals process.

- File a Formal Appeal: Follow the insurance company’s guidelines to submit a formal appeal, including your supporting documentation.

- Be Persistent: The appeals process can take time. Follow up with the insurance company and be persistent in advocating for your case.

Collection Process in Medical Billing and How to Avoid It

People want to avoid dealing with collections. Here’s how to prevent it:

- Communicate with Your Provider: If you’re facing financial difficulties paying your bill, contact the healthcare provider’s billing department. They offer payment plans or financial assistance programs.

- Understand Your Payment Options: Explore different payment options offered by the healthcare provider.

- Pay on Time: Even if you can’t pay the total amount upfront, make consistent partial payments to demonstrate your commitment.

Challenges in the Medical Billing Process

Despite its importance, the medical billing process is riddled with challenges, including:

- Complexity: The evolving healthcare landscape, coupled with intricate billing regulations and coding guidelines, can overwhelm healthcare professionals and lead to errors.

- Billing Errors: Inaccurate coding, incomplete documentation, and data entry mistakes can result in claim denials or delays, impacting cash flow and patient satisfaction.

- Regulatory Compliance: Healthcare providers must navigate through a maze of regulatory requirements, including HIPAA (Health Insurance Portability and Accountability Act) regulations, to ensure patient privacy and data security.

Related Article: Medical Billing and EHR

Conclusion

Understanding the medical billing process empowers you to be a more informed patient. By familiarizing yourself with the steps involved, your rights, and how to navigate potential issues, you can ensure a smoother experience. Remember, you’re not alone in this journey. Be bold, ask questions, and seek clarification whenever needed. With a bit of knowledge and proactive communication, you can navigate the medical billing maze with confidence.

The medical billing process is a critical aspect of healthcare administration, impacting both providers and patients. Understanding its intricacies and implementing strategies to enhance efficiency can lead to improved financial outcomes and patient satisfaction. By following the steps outlined in this guide and embracing innovative solutions, healthcare providers can navigate the complexities of medical billing with ease.

Read Also: Discover What a Medical Billing Company Can Do for You

Still have questions about the medical billing process? We’re here to help! Leave a comment below with your specific concerns, and we’ll do our best to provide clear and informative answers. Remember, knowledge is power, and when it comes to your healthcare experience, being informed is critical!

Stay informed, stay ahead! Our Facebook page, PreciseBS, provides access to the latest industry insights and trends, keeping you at the forefront: PreciseBS Billing Services

Frequently Asked Questions

Q: What is the medical billing process?

The medical billing process is how healthcare costs are managed after you receive treatment. It involves your healthcare provider sending a bill to your insurance company for the services you received, and then you may receive a bill for any remaining costs.

Q: How does insurance verification work in the medical billing process?

Insurance verification is when your healthcare provider checks with your insurance company to see what medical services they will cover and how much you might need to pay out of pocket. This helps ensure you won’t be surprised by unexpected bills later.

Q: What are some common reasons for claim denials in medical billing?

Claim denials can happen due to coding errors, missing information on the claim, or if the insurance company doesn’t think the service was necessary for your health condition.

Q: What can patients do if they receive a medical bill they can’t afford to pay?

Patients facing financial difficulties can contact their healthcare provider’s billing department to discuss payment plans or financial assistance options. It’s essential to communicate early to find a solution.

Q: How can healthcare providers improve the efficiency of the medical billing process?

Healthcare providers can enhance efficiency by using electronic health records (EHR), providing regular staff training, utilizing revenue cycle management (RCM) software, and conducting routine audits to identify and fix any errors or issues in the billing process.

Q: How can I avoid a bill going to collections?

Talk to your healthcare provider’s billing department if you’re having trouble paying your bill. They may offer payment plans or financial assistance.

Understand your payment options and make consistent partial payments if you can’t pay in full upfront.

Communicate with your provider about any billing errors.

Q: What can I do if my insurance denies a claim?

If your insurance denies a claim, you can appeal the decision. Here’s how:

Gather documents supporting the service’s necessity, like a copy of the denial letter and medical records.

Call your insurance company and ask about the appeals process.

File a formal appeal with your supporting documents following the insurance company’s guidelines.

Be persistent and follow up with the insurance company to advocate for your case.

Q: How can I be a more informed patient about medical billing?

Ask questions! Feel free to ask your healthcare provider or insurance company about any charges or procedures.

Carefully review your bills before making a payment to check for errors.

Keep copies of EOBs, bills, and any communication with your insurance company.

Familiarize yourself with your insurance plan’s terms, deductibles, and copays.

People Also Ask

What happens if my insurance company denies a claim?

If your insurance company denies a claim, you have the right to appeal the decision. This involves providing additional documentation to support the medical necessity of the service.

Can I negotiate with my healthcare provider if I can’t afford to pay my medical bill?

Yes, you can negotiate payment plans or discuss financial assistance options with your healthcare provider’s billing department. They may be willing to work with you to find a solution.

How long does the medical billing process typically take from start to finish?

The duration of the medical billing process can vary, but it usually takes a few weeks from the time you receive medical services to when the insurance company processes the claim and you receive a bill.

What should I do if I notice an error on my medical bill or explanation of benefits (EOB)?

If you spot an error on your medical bill or EOB, contact your healthcare provider’s billing department or your insurance company to address the issue and ensure accurate billing.

Are there any free resources available to help me understand the medical billing process better?

Yes, many online resources and organizations offer guidance on navigating the medical billing process and understanding healthcare costs. You can also reach out to patient advocacy groups or financial counselors for assistance.

What are the common reasons why claims get denied?

There are a few reasons why claims might get denied:

- Coding errors: Mistakes in medical codes can confuse the insurance company and lead to rejection.

- Missing information: Incomplete claims lacking necessary details might get bounced back.

- Lack of medical necessity: If the insurance company believes a service is not necessary for your condition, they may deny coverage.

What happens if I don’t pay my medical bill?

If you don’t pay your medical bill, it could be sent to collections. This can negatively impact your credit score.

How can I appeal a denied insurance claim?

If your insurance company denies your claim, you have the right to appeal the decision. This typically involves gathering documentation to support the medical necessity of the service and following your insurance company’s appeals process.

What are some ways to make medical billing more efficient?

There are strategies healthcare providers can use to improve the efficiency and accuracy of medical billing, such as using electronic health records (EHR), training staff on coding and billing regulations, and utilizing revenue cycle management (RCM) software.